Your Auto-Enrolment Questions Answered

Your Auto-Enrolment Questions Answered

Workplace pensions are coming for small businesses, and there is no escaping them. Fortunately, there’s plenty of auto-enrolment advice online. But, to save you wading through the pages of information, you can simply read on to find out the basics and learn what your company needs to do to comply with the new laws.

What is Auto-Enrolment?

Auto-enrolment workplace pensions are pensions arranged by employers for their staff. A percentage of an employee’s pay is paid into a pension scheme on their pay day. Even if you only have one member of staff, you will still be required to sign up for auto-enrolment.

Staff don’t actually have to do anything (hence the ‘auto’ part), but employers do. If you do not sign your business up to a pension company, your business can face enforcement action, including fines and/or prosecution.

When Do You Have To Act?

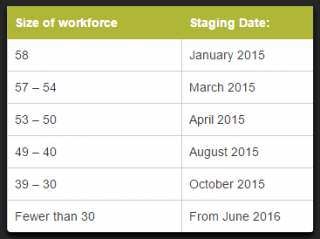

The date you have to introduce workplace pensions is dependent on the size of your organisation. Auto-enrolment came into force in 2012, with many large firms signing up to the scheme. All existing firms must have their employees in a scheme by April 2017. New employers will need to have their staff enrolled by February 2018.

The date you have to introduce workplace pensions is dependent on the size of your organisation. Auto-enrolment came into force in 2012, with many large firms signing up to the scheme. All existing firms must have their employees in a scheme by April 2017. New employers will need to have their staff enrolled by February 2018.

An auto-enrollement timetable is available that breaks down further details regarding the sizes of businesses, when they were established and how this affects their auto-enrolment start date.

Who is Eligible?

Workplace pensions are for all employees who:

- Are not currently enrolled on a workplace pension

- Are aged 22 and above

- Under state pension age

- Earn over £10,000 a year

- Are employed in the United Kingdom

Can Employees Opt Out?

Yes. It is not compulsory for employees to be enrolled on the scheme. However, the workplace pension does provide a simple and consistent way for staff to save for their pension. The Money Advisory Service offers a useful tool for staff unsure about whether joining the workplace pension is right for them.

We have heard that some small businesses are considering taking on staff as freelancers to avoid having to set up auto-enrolment. However, there are companies, such as The Workplace Pension Consultancy in Chelmsford, who manage the process for businesses.

What Information is Required?

You will need to provide your pension provider with at least the following information on your employees:

- Date of birth

- Name

- Address

- National Insurance number

You must also keep records and inform your pension provider of any new starters and updates to employee’s address details.

How Much Will it Cost?

One of the big questions on employers’ minds is the cost of pension contributions. As well as increased admin for your payroll staff, you will also need to consider the possibility for paying for initial pension set-up costs too.

The amount of money you will need to contribute to every employee’s pension depends on when you sign up to the scheme and how much the individual earns. Minimum contributions levels are being phased in and by October 2018, employers will be expected to pay a three per cent minimum contribution.

Find out the exact contribution both you and your employee will need to make by using an online employer contribution calculator.

When Must You Pay Contributions?

Employer contributions must be paid by the 22nd day of the month, in accordance with your pension provider’s terms. If you are paying by cheque, you need to pay in by 19th of the month.

Next Steps

Your next steps should be to find out the deadline for your organisation’s enrolment date. This is called your ‘staging date’. You should then start planning for automatic enrolment at least six months before this date. Whatever you do, do not miss this date, as you may face a fine.

You then need to find a suitable pension provider by using an independent pension advisor. What might be right for a large organisation is unlikely to be suitable for a small business. Make time to carry out plenty of research and be aware that although useful, online calculators are not always accurate.

Once you have reached your staging date, you have six weeks in order to write to your staff to tell them about how automatic enrolment will affect them.

Workplace pensions don’t have to be complicated. As long as you keep an eye on dates and ask for advice from a trusted source, providing a decent pension not only means you are complying with the law, but also that you are providing for every employee’s future. Another important fact to remember is that generous pension schemes can also help retain staff and reduce employee turnover, saving you money in recruitment costs and helping you attract the best employees. If you need advice, contact a consultant or seek an online business help club to learn more.